Part 8 of series - Investing, not rocket science - Financials (Europe): BNP, UBS, ABN, STAN and DB.

- Ranjeet M CFTe

- Mar 3, 2023

- 2 min read

Updated: Mar 7, 2023

Welcome to this part of the series. A quick recap of what is done so far:

Part 1: Defined a basic framework for the portfolio, Parts 2 to 7: added Alphabet, Emerson, Infineon, BMW and UK Gilts to the portfolio. I shared 1 portfolio update. You may have noticed from the evaluation that I prefer valuations on a stock to momentum or a growth story. There are exceptions, like a buy idea on Tesla in Jan this year.

I would like to add financial stocks to the portfolio. Reason being that we are in a rising interest rate scenario in most parts of the world and theoretically financial stocks should do well in this environment (unless the rising interest rate scenario is followed by a recession). At this point however, the probability of a recession is not high (although economic data is backward looking).

There are many financial stocks to choose from and for the purpose of a fair evaluation, I am going to split it into three parts: European, US and Asian financials with a focus on banking stocks. Even in this I can only choose 4 to 5 stocks from a universe of at least 10 times that size (I can't have every stock in my portfolio!).

Today, its European financials stocks and I am going to evaluate: BNP Paribas, UBS, Standard Chartered, ABN Amro Bank and Deutsche Bank.

Company financials:

Revenue to Mkt Cp multiple around 1.8 to 1.95, except for Deutsche Bank (below 1).

Net interest income 50 to 55% of Interest income on loans, except ABN Amro (70%).

Deutsche Bank has the highest earning yield at 22.1% while the other four have earnings yield between 10.1 to 12.9%

Efficiency and valuation:

Return on assets low (range of 0.4 to 0.7%)

Operating income margin between 20 and 30%

Price to Tangible book less than 1, except UBS

PE ratio between 4.6 and 10.4 (Deutsche Bank is the lowest)

Deutsche Bank has the lowest PE and PB (tangible book) ratios.

Trends in financials and fair value:

Revenue growth low, in the range of 2.1 and 7.3%, UBS negative

Interest income broadly consistent, BNP has fluctuating data

Variations in non interest income, Standard Chartered most consistent with a rising trend. Deutsche Bank on recovery mode since 2019.

Though Deutsche Bank has the lowest operating margin, it shows marked improvement since 2018 (from 8% to 21% currently) and is trending higher.

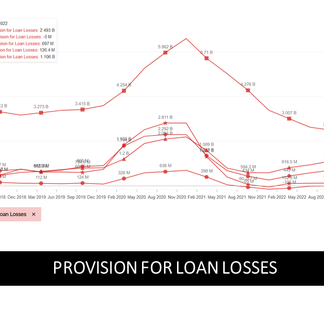

Provisions for bad loans similar (seems to follow economic cycle).

Deutsche Bank is undervalued, has more upside potential according to analyst estimates and comparative fair value.

On the charts, Deutsche Bank is broadly trading in a range between Eur 6 and 12 (since 2018) with a high of 14 and a low of 4.6. It is currently trading at the upper end of the range at EUR 11.67

Portfolio action: Buy Deutsche Bank

Add to watchlist: BNP, UBS, Standard Chartered, ABN Amro

Although I did not expect this when I began the evaluation, I am glad to find value in Deutsche Bank and look forward to adding it to the investment portfolio on Monday (06 March 2023).

In the next part of this series, I would evaluate US financial stocks.

Watch the videos of this series on our social media pages.

Please subscribe, follow, like!

Thanks for your time!