I am looking to add automotive stocks to the portfolio and I have shortlisted BMW, Mercedes Benz, Tesla, Toyota and Volkswagen for a quick evaluation in this part of the series.

Company financials:

Tesla's Market cap is about 8 times its annual revenues.

The remaining 4 stocks have market caps below their annual revenues.

Tesla, BMW and Mercedes have generated positive free cash flow.

NI margin + Div Yield: BMW @ 19.6%, Mercedes @ 16.1% and Tesla @ 15.4%

Efficiency, valuation & volatility:

Tesla has a volatility of 68%, Toyota and BMW have volatility of 26 to 28%

Tesla leads operating income margins with 16.8%, Mercedes is at 12.2% and BMW has a OI margin of 10.6%.

PE ratio: BMW least expensive stock with a PE ratio of 3.5, Tesla the highest at 52.2

PEG ratio: Tesla is impressive.

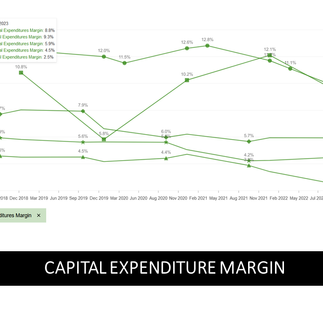

Trends in financial data:

Tesla a growth stock with 50% growth in revenues, trending lower.

BMW most consistent in Revenues and Operating income margins.

Tesla operating income margin in a rising trend.

Tesla offers discounts likely due to rising inventories.

Tesla and BMW show consistency in generating free cash flow.

Fair value and upside potential:

BMW, Mercedes and Toyota show growth potential. However, considering trends in the financial data, BMW and Tesla would be my picks for this investment portfolio. However, Tesla is priced too high at this time and I would reconsider if there is a pull back in stock prices.

Portfolio action: Buy BMW

Add to watch-list: Tesla, Toyota, Volkswagen and Mercedes.

In the next part of this series, I would like to evaluate financial stocks.

Watch the videos of this series on our social media pages.

Please subscribe, follow, like!

Comments