Part 10 of series - Investing, not rocket science - Financials (ASIA)

- Ranjeet M CFTe

- Mar 8, 2023

- 2 min read

Updated: Mar 10, 2023

Welcome to this part of the series on building and managing an investment portfolio. A quick recap of what is done so far:

Part 1: Defined a basic framework for the portfolio, Parts 2 to 7: bought Alphabet, Emerson, Infineon, BMW and the UK Gilts (also shared 1 portfolio update). In part 8, I began evaluation of financial stocks, starting with European financials and shortlisted Deutsche Bank to be added to the portfolio. In part 9, I evaluated U.S. financials and shortlisted Citi, however I would like to complete the evaluation of Asian financials in this part before I make a portfolio decision.

The stocks to evaluate today: Sumitomo Mitsui, ICBC, Postal savings bank of China, Westpac, ICICI Bank and HDFC Bank.

Company financials:

Annual revenue to market cap multiple highest for HDFC at 9, making it the most expensive stock in this evaluation. ICICI and Westpac between 4.5 and 5.5. ICBC at 2. and Sumitomo Mitsui and Postal Savings Bank of China between 1.4 and 1.8.

Net interest income around 60% of interest income on loans. Westpac leads with 74% and Sumitomo Mitsui is the lowest at 41%.

ICBC has an earnings yield of 24.2% followed by the Postal Savings Bank of China at 18%. ICICI and HDFC have a low earnings yield at 4.8 to 5.3%

Efficiency and Valuations:

Price to Tangible book ratio low for ICBC, Postal Savings bank and Sumitomo Mitsui (0.4 to 0.7). ICICI and HDFC bank have a ratio of 3 to 3.4

PEG Ratio positive for all, lowest for Postal Bank

Return on Asset, which is dependent on the interest rates, between 0.3 (Japan) and 2.1% (India)

Operating income margin highest for ICBC at 56.6% followed by HDFC at 54.9% and 49.3% for Westpac.

Trends in financials and fair value:

Revenues trends similar for all 5 banks, with a stable performance by HDFC.

Interest and Non interest income broadly flat in trend, with some variation for ICBC in non interest income.

Operating income margin stable for HDFC and trending higher for ICICI and Postal Savings bank.

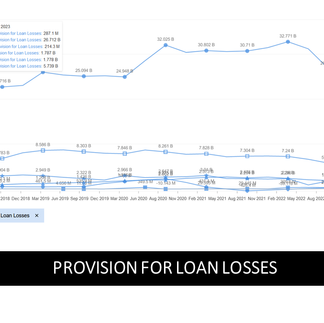

Provisions for Loan Losses trends flat to lower.

Fair Value and Upside potential: on an average of both methods, ICBC has the most upside potential followed by the Postal Bank of China.

On the charts: comparing performance from 2000, ICICI and HDFC have outperformed the others by a wide margin.

ICBC and Postal Savings bank of China have the least comparative performance.

From this analysis, ICBC comes out as a clear winner and a potential addition to the portfolio. However, the only concern is in its Provision for Loan losses, although trending lower, is currently higher than JP Morgan (similar revenues).

At the end of this evaluation, I am going to add both ICBC and Citi to the portfolio. In the next post: a portfolio update and a market catch-up.

Watch the videos of this series on our social media pages.

Please subscribe, follow, like!

Thanks for your time!