#Investing, Not Rocket Science - 18 - Portfolio Review and evaluate stocks from Insurance Sector

- Ranjeet M CFTe

- Apr 6, 2023

- 5 min read

Peace and health to everyone in view of the long Easter weekend! Welcome to this 18th post of investing, not rocket science! Investing Doesn't Have to Be Rocket Science: this is our Non-Expert Guide to Portfolio Management.

A quick recap this series so far:

In the 1st post: I defined a basic portfolio framework. The objective of this million dollar portfolio is beat inflation and an equity index. Active portfolio management, without the use of leverage and a time horizon greater than 5 years. The benchmark index is the MSCI ACWI IMI.

From posts 2 to 17: I have evaluated 59 stocks and 4 potential bond additions. The portfolio is long 14 stocks, 1 Bond and short 1 stock. You can read all about it in the previous posts here: https://www.claritech.app/blog

This week, we begin with a portfolio overview and evaluation of these stocks from the Insurance Sector: Generali, Aviva, Zurich Insurance, American Financial Group, People’s Insurance Group

Portfolio update:

· Since Inception, the portfolio is up +2.98%, the benchmark index is down -0.94%

· All Asset Classes: Equities, Bonds, Real Estate and Cash have contributed to positive performance in the portfolio.

· Risk Measures: Sharpe ratio: 3.04 Sortino Ratio: 4.37 Standard Deviation 0.35%

This portfolio has outperformed the benchmark, all asset classes have contributed to this outperformance and the risk measures are good.

All positive news currently! The challenge will be to maintain consistency.

Portfolio details:

· The largest detractors continues to be Deutsche Bank (-18.9%) followed closely by Citigroup (-9.36%). Though downward pressure continues to remain on the financial sector, these stocks have bounced up nicely from their lows last month.

· The biggest gainers: JD.com (+13.3%), Google (+16.7%) and Glencore (+12.9%). Infineon (+5.2%) and US Steel (+1.8%), while positive have fallen this week.

· The hedge (short position in Nvidia) is in the green by 0.65%, which means the stock is lower. Most of this downside took place yesterday when Google announced that’s its AI Supercomputer was faster and greener than Nvidia.

Asset Allocation:

After a series of continuous evaluation, this portfolio is now 38% in Equities, 31% in Fixed Income, 5% in Real Estate and 26% in Cash.

I think there is room for more equity exposure, both on the long side and the short side (hedge). More of this next week.

Let’s dive into todays evaluation:

The objective is to assess stocks from the Insurance Sector. Interest rates have been low in since 2008 and insurance companies have been forced into equities for yields. This may no longer be the case, since these companies can “de-risk” from equities and look at Bonds at current yields.

To assist with the evaluation will be the semi-quant method that I introduced in post 14. This should help avoid biases while assessing financial data of these stocks.

Why should I invest in stocks from the Insurance Sector?

Here are some of the reasons:

1. Dividends: Insurance companies generate earnings from insurance premiums and investments, which can provide a stream of dividends for shareholders.

2. Diversification: Insurance companies offer different types of policies, such as life, health, and property insurance, and can be exposed to different risks and economic cycles, providing diversification benefits.

3. Exposure to rising interest rates: Insurance companies invest the premiums they collect, and rising interest rates can lead to higher investment income and higher profits for insurance companies.

However, there are also risks associated with investing in insurance stocks. These risks can include regulatory changes, catastrophic events, and company-specific risks, such as underwriting losses and investment losses.

Company Financials:

· Revenue multiple: Generali and People’s Insurance look relatively undervalued at 0.4x and 0.3x of their annual revenues, followed by AFG (1.5x) and Zurich Insurance (1.7x).

· Generali and People’s Insurance also have a high earning yield around 12% followed by AFG and Zurich.

· Aviva has the highest unlevered free cash flow margin at 43.8%

Efficiency, Valuation and Volatility:

· Aviva leads with high operating income margin and low PEG ratio. Operating income is lowest at Generali and People’s Insurance. PEG ratio is negative for AFG and Zurich.

· AFG has a low debt / equity (40%) followed by Aviva (58%)

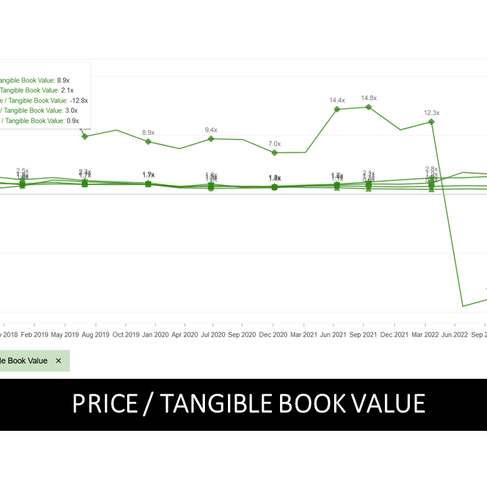

· Price / Tangible Book Value lowest for People’s Insurance Group.

· Realized volatility for these stocks are between 20% and 28%

Trends in Company Financials:

· Aviva sees the largest jump in its operating income. Zurich Insurance sees a rising trend in operating income as well.

· Price to tangible book value: Aviva and AFG see stable trends over the last five years. Generali sees an increase in the ratio while Zurich and People’s Group have negative ratios.

· Earnings Yield stable for AFG, Generali and People’s Insurance Group. Aviva sees the largest decline in earning yield.

· Unlevered Free Cash Flow: rising trends for Aviva and People’s Insurance Group, Declining trend for Zurich Insurance.

Fair Value, Upside Potential and Dividends:

· I assess fair value and upside potential using two methods: Fair Value (InvestingPro) and the Analysts Fair Value estimate. While the InvestingPro method is objective and based on their valuation models, the analyst fair value is subjective to the view of the analyst. Both are important and an average of the two tends to provide a good indication of the potential upside.

· People’s Insurance Group, Aviva and AFG sees the most upside potential on average.

· The same three also generate relatively high dividend yields.

The reason I go through this process is because there is a risk in depending on one or two financial metrices to make an investment decision. Research is a continuous process, although I must also say that fundamental analysis is based on past data and performance, there is no guarantee that the trend will continue. Research can reduce risk, cannot eliminate it.

Summary of the evaluation:

Although it may not have looked like it when this evaluation began, Aviva is the addition to the portfolio from among these companies. The chart and a summary of the semi quant is on the illustration below. I am going to add Zurich Insurance, AFG and People’s Insurance Group to the watch list. Generali is already on the watch list from the previous post.

If you or someone you know is interested in receiving a free remote consultation on their investment portfolio, regardless of location, please don't hesitate to contact us.

This series is for information purposes only without regard to any particular investment objective, financial situation, suitability or means. It is not be construed as a recommendation, or any other type of encouragement to act, invest or divest in a particular manner (whether explicit or implicit). We recommend that you are familiar with the terms of use.

Next week, we are likely to see the start of earnings season for Q1 2023 and I will be tracking news, results and price movement for the stocks in this portfolio and on the watchlist.

Thanks for your time! See you in the next post!

Visit our social media pages and please subscribe, follow, like!