#Investing, Not Rocket Science - 17 - Markets, Portfolio, LGEN, BATS, MAERSK, SREN, VOD, FMG, G

- Ranjeet M CFTe

- Apr 3, 2023

- 5 min read

Updated: Apr 5, 2023

Happy Monday and the Week Ahead! Welcome to this 17th post of investing, not rocket science! Investing Doesn't Have to Be Rocket Science: this is our Non-Expert Guide to Portfolio Management.

A quick recap this series so far:

In the 1st post: I defined a basic portfolio framework. The objective of this million dollar portfolio is beat inflation and an equity index. Active portfolio management, without the use of leverage and a time horizon greater than 5 years. The benchmark index is the MSCI ACWI IMI.

From posts 2 to 16: I have evaluated 59 different stocks and 4 potential bond additions. The portfolio is long 11 stocks, 1 Bond and short 1 stock. You can read all about it in the previous posts here: https://www.claritech.app/blog

This week, we begin with a market update, followed by a portfolio overview and evaluation of the following dividend stocks: Legal & General Group, British American Tobacco, Maersk, Swiss Re, Vodafone, Fortescue Metals and Generali

Market Update:

Equity markets were up for the week, with the MSCI World closing +3.29% and MSCI Emerging Markets +2.46%. Some of the key data and news from last week:

· PCE Price index gains 5% in Feb, slower than the 5.3% gain in Jan. Core PCE dips to 4.6% in Feb from 4.5% in Jan.

· First Citizens bank acquires US$72Bn of SVB’s deposits and loans at a discount of US$16.5Bn.

· Apple launches its buy now pay later financial service.

· FDIC Chairman Michael Barr told the Senate Banking Committee that more regulation was required in the Banking Industry, including raising capital and liquidity standards for banks over US$100Bn.

· UBS brings back former CEO Sergio Ermotti to lead the Bank through its acquisition of Credit Suisse.

· Alibaba will split into six business groups, which will have its own CEO and Board of Directors and ability to raise capital. These are the groups: Cloud Intelligence Group, Taobao Tmall Commerce Group, Local Services Group, Cainiao Smart Logistics, Global Digital Commerce Group, Digital Media and Entertainment Group.

OPEC+ announces a surprise drop in oil production of 1.6mbpd (about 3.5% of production). Saudi Arabia said it will implement a voluntary cut of just under 5% of its oil production. Oil prices are trading up nearly 5% on the news.

Portfolio update:

· Since Inception (14FEB2023) to yesterday (29MAR2023), the portfolio is up +2.88% while the benchmark index is down -0.65%

· Asset Class: Equities, Bonds and Cash have contributed to positive performance in the portfolio. The Real Estate stock is slightly lower.

· Risk Measures: Sharpe ratio: 3.2 Sortino Ratio: 4.62 Standard Deviation 0.35%

· In my understanding, some of the key reasons for this outperformance: Diversification (Asset Classes and Stock Sectors), Research before decisions, current cash exposure at 25%.

· There is however, market risk that cannot be avoided in a portfolio, unless I were to redeem completely and move into cash. Which unfortunately may not be the best option in the current inflationary scenario.

Portfolio details:

· The largest detractors: Deutsche Bank has fallen -18% followed closely by Citigroup (-7%). Although it must be said that both these stocks have bounced up nicely from their lows last month.

· The biggest gainers: JD.com (+17%), Google (+16%), Glencore (+14%), Infineon (+11%) and US Steel (+8%)

· The hedge (short position) is in the red by 2.65%, which means the stock is up.

Let’s dive into todays evaluation:

The objective is to assess stocks from a variety of sectors for good fundamentals and dividend history. I am particularly interested in the Insurance Sector (Legal & General, Generali and Swiss Re) since its performance may not be affected by economic cycles. In addition to this, interest rates have been low in since 2008 and insurance companies have been forced into equities for yields. This may no longer be the case, since these companies can “de-risk” from equities and look at Bonds at current yields.

To assist with the evaluation will be the semi-quant method that I introduced in post 14. This should help avoid biases while assessing financial data.

Are Dividends important?

I can answer that with an example of the stock price of JPMorgan Chase. The stock has delivered a return of 19% in the last 5 years on its stock price. When adjusted for dividends the return in the last 5 years is 38%. That’s because the stock generates a dividend stream of about 3.5% per year.

Company Financials:

· Revenue multiple: Maersk looks relatively undervalued at 0.4x its annual revenues, followed by Generali (0.4x), Vodafone and Swiss re (0.6x).

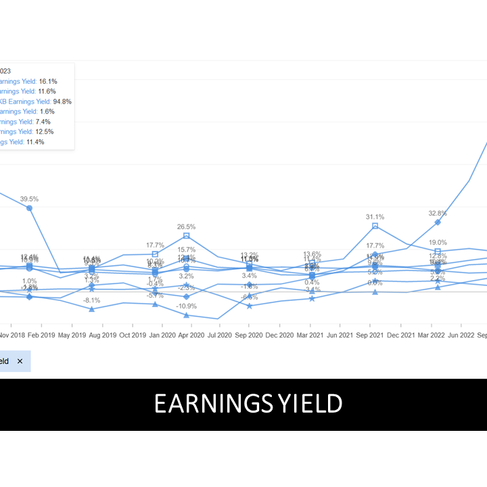

· Maersk has a high earnings yield (94.8%) while LGEN, FMG, BATS and G have an earnings yield in a range of 11.4 to 16.1%

· LGEN has a high Free Cash Flow. All 7 companies generate positive Free Cash Flow.

Efficiency, Valuation and Volatility:

· FMG and BATS have an operating income margin above 40%, followed by Maersk at 37%.

· Price to Tangible Book ratio: relatively well priced for Maersk (0.6x) and LGEN (1.2x).

· Realized volatility highest for Maersk at 42% and lowest for BATS (20%)

Trends in Company Financials:

· Maersk and BATS have stable trends in their Revenues.

· While Maersk has a high earnings yield, its average over the last 5 years is at 23%, followed closely by FMG at 21%

· LGEN sees volatility in the trends for Unlevered Free Cash Flow. Trends are stable for BATS, FMG, MAERSK, SWISS RE, VOD and G.

· The quarterly earnings report for this quarter (Q1 2023) are likely to begin in 2 to 3 weeks and the latest data will certainly add to the trend analysis. This is a continuous process, although I must also say that fundamental analysis is based on past data and performance, there is no guarantee that the trend will continue. Research can reduce risk, cannot eliminate it.

Fair Value, Upside Potential and Dividends:

· I assess fair value and upside potential using two methods: Fair Value (InvestingPro) and the Analysts Fair Value estimate. While the InvestingPro method is objective and based on their valuation models, the analyst fair value is subjective to the view of the analyst. Both are important and an average of the two tends to provide a good indication of the potential upside.

· BATS, MAERSK and VOD sees the most upside potential on average.

· MAERSK, VOD and LGEN generate relatively high dividend yields.

Summary of the evaluation:

Maersk is the clear choice for a dividend payout. I just missed an ex-dividend date last week. However, the downside risk is that Maersk is in a sector that can see direct impact from economic activity. For the purposes of diversification, I am going to add Vodafone to the portfolio as well. I was hopeful about the insurance stocks and that did not pan out as expected.

If you or someone you know is interested in receiving a free remote consultation on their investment portfolio, regardless of location, please don't hesitate to contact us.

This series is for information purposes only without regard to any particular investment objective, financial situation, suitability or means. It is not be construed as a recommendation, or any other type of encouragement to act, invest or divest in a particular manner (whether explicit or implicit). We recommend that you are familiar with the terms of use.

Do you see an inappropriate ad? Please send us a screenshot and we can raise a concern with the third party vendor to mitigate the problem.

In the next few posts, I evaluate more stocks that can be added to this portfolio from the insurance sector and travel and tourism. Thanks for your time! See you in the next post!

Visit our social media pages and please subscribe, follow, like!