Today, I would like to introduce a quantitative method to overcome certain biases while evaluating financial information. Welcome to this 14th post of investing, not rocket science! Investing Doesn't Have to Be Rocket Science: Our Non-Expert Guide to Portfolio Management.

Summary of the FOMC press conference and economic projections:

· Increases interest rates by 0.25% to the range of 4.75% - 5%

· The FOMC expects the current stress in the banking sector to have a deflationary effect on the economy. As flow of credit slows, bringing down economic activity and thus inflation as well.

· While the statement emphasis a commitment to bring inflation to the target of 2%, there is a softening of tone about future rate increases (which continues to be data dependent) to "some additional policy firming may be appropriate" from "ongoing rate increases."

· Projections for PCE and Core PCE inflation has shifted to the right from December'22, indicating an expectation of sticky inflation.

· Projections for year end interest rates 2023 remains unchanged in the range of 5.1% - 5.3% and for 2024 remains unchanged at 4.1% - 4.3%.

· High uncertainty remains on PCE, Core PCE and GDP projections.

· The FED is assessing reasons for failure of Silicon Valley Bank and looks to implement policies in place to avoid similar events in the future. (Strangely, current policies in the US do not include interest rate risks in stress tests for banks).

A quick recap is done so far:

In the 1st post: I defined a basic portfolio framework. The objective of this million dollar portfolio is beat inflation and an equity index. The style is active portfolio management, without the use of leverage and a time horizon greater than 5 years. The benchmark index is the MSCI ACWI IMI.

From posts 2 to 13: I have evaluated 47 stocks and 4 potential bond additions. The portfolio is long 10 stocks and 1 Bond.

Home bias and geographic diversification:

For those of us who haven't looked outside a particular country or geography for investment options in financial markets; this is considered to be home bias (The tendency to only consider investments that we think is familiar to us). While US stocks have led global growth in recent times, geographic diversification is useful in a portfolio. Speaking of which, this particular investment portfolio is under-invested in Asia.

In this post, I am going to evaluate the following stocks from the Real Estate sector: CapitalLand Investment (based in Singapore), Deutsche Wohnen (based in Germany), Mitsubishi Estate, Sumitomo Reality (both based in Japan) and Swire Properties (based in Hong Kong). Global real estate companies tend to function the same way.

Company Financials:

· The Japanese real estate firms trade at a relatively attractive multiples to their LTM revenues at 1.5x

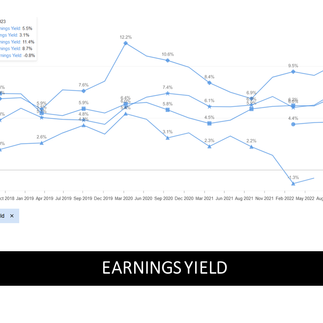

· In terms of earnings yield, both the Japanese firms lead the way once again followed by Swire Properties at 5.9%.

· Swire Properties has a high unlevered free cash flow margin at 41.7% followed by CapitalLand at 24.5%. Mitsubishi Estate and Deutsche Wohnen have negative free cash flow.

· Current ratios for Swire and Sumitomo Reality are within an ideal range of 1.5 to 2.

Efficiency, Valuation and Volatility:

· Swire Properties operates with a high operating income margin of 59% followed by CapitalLand and Sumitomo Reality at 30.3% and 25.6%.

· PEG ratio is favorable for Deutsche Wohnen and Mitsubishi Estate.

· Debt / Equity ratios are high for both Japanese firms (not unusual for real estate companies) and lowest for Swire Properties at 8.2%.

· Price / Tangible book value relatively attractive for Swire Properties at 0.4x

· Realized volatility in the last 1 year lowest for Swire Properties and Mitsubishi Reality at 23%

Trends in Company Financials:

· Revenue growth highest for Deutsche Wohnen at 33% followed by CapitalLand at 23%, although with volatility in the trend.

· Operating income margin highest for Swire Capital, maintained consistently in the last 5 years. Mitsubishi Estate and Sumitomo Reality also maintain consistency in their operating income margins at 22.7% and 25.6%

· Trends in earning yield: both Japanese companies maintain leadership in the last 5 years, followed by Swire Properties.

· Mitsubishi Estate has not generated positive free cash flow in the last 5 years.

· Inventory outstanding days lowest for CapitalLand and highest for Swire Properties.

Fair Value, Upside Potential and Dividends:

· I assess fair value and upside potential using two methods: Discounted Cash Flow analysis and the Analysts Fair Value estimate. Both are important and an average of the two tends to provide a good indication of the potential upside.

· According to InvestingPro: CapitalLand and Swire Properties are undervalued and are currently trading below their estimated fair price.

A possible quantitative method:

I have a tendency to pick stocks that are undervalued and relatively inexpensive. This is a potential bias, since it is not necessary that a undervalued stock needs to appreciate in price. For example: I thought both Citi and Deutsche Bank are undervalued but they have fallen the most in the portfolio (To be fair, the financial sector has seen selling pressure in the last one week).

In an attempt to overcome bias, I have designed a simple quantitative method to help me make an investment decision. For each of the 16 financial metrices (grouped in 4 categories) that I assess, a score is assigned to the company depending on its performance, consistency and stability or upward trend. There is a level of subjectivity since I am the one who assigns the scores (I could eventually automate this process).

Based on this evaluation, I am going to add Swire Properties to the investment portfolio.

Hedging opportunities:

Using the same quantitative method, I have assessed Google, Infineon, Glencore, JD.com and Emerson from the portfolio along with Nvidia and AMD, which look like the most expensive stocks in the watchlist. The first objective was to check if I had picked the right stocks and the second is to look at hedging opportunities via AMD or Nvidia against a potential fall in equities.

Please refer illustration above for a snapshot of the evaluation.

What is the strategy here?

By selling 550 stocks of Nvidia (approx. US$150,000), the expectation is that in the event of a downside in equities, the fall in the value of Nvidia will cover or exceed the losses seen in Google, Emerson, JD.com and Infineon.

If there is no downside in equities and financial markets rally on the upside, the expectation is that the appreciation in value of Nvidia will be lesser than that of Google, Emerson, JD.com and Infineon. Could be useful to hedge against medium term financial market volatility.

This is could also be seen as a long-short strategy (buy an undervalued stock and short an overvalued stock in the same industry / industry group). The potential risk: Nvidia rises in value while the other stocks fall in value.

Thanks for your time! See you in the next post!

Watch the videos of this series on our social media pages.

Please subscribe, follow, like!